Big Labor Lies to Teachers About Their Pensions

Young Teachers Should Know No Money May Be Left When They Retire

For years now, many of the government retirement funds set up across the U.S. to ensure the pensions of K-12 employees and other public servants are safe have been in serious trouble.

Forced-unionism Illinois is an especially egregious case.

The Prairie State’s pension crisis is arguably the worst in the nation. According to the Illinois Commission on Government Forecasting and Accountability, the state Teachers’ Retirement System (TRS) is only 38.6% funded.

Unfortunately, information supplied to rank-and-file educators by union officials who themselves are largely responsible for this vast pension shortfall does not even acknowledge the very real possibility that the TRS could run out of money before many current teachers retire.

Big Labor Bosses Benefit, But Schoolkids, Taxpayers, And Most Teachers Get Hurt

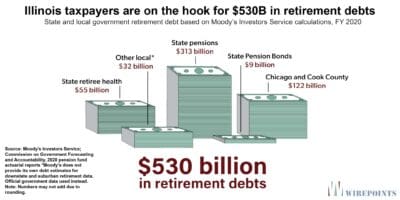

“Theoretically, the massive shortfalls in the TRS and other Illinois government pension funds, estimated to add up to a flabbergasting $530 billion, could be fixed by slashing non-pension spending or by hiking taxes,” said National Right to Work Committee Vice President John Kalb.

“But more than 25% of state revenue already goes into pensions and retiree health care. And Illinois’ aggregate state-local tax burden as a share of income is already higher than in 40 out of the 50 states.

“Working-age Illinoisans, especially those who have children at home, are already fleeing the state in droves because onerous business taxes are suppressing job growth and exorbitant property taxes are making housing unaffordable. And every net taxpayer loss puts Illinois’ government pension funds deeper in the hole.

“As a practical matter, shoveling the billions and billions of additional taxpayer dollars into the TRS it would take to make teacher union bosses’ pension promises keepable is not a viable option.

“And even if it were possible, it wouldn’t make sense to add insult to taxpayers’ injury and divert even more education dollars away from the classroom, where it is at least possible to make a positive difference in students’ lives, to prop up a retirement system that shortchanges most public educators.

“A 2021 analysis by Bellwether Education Partners ranked Illinois at the bottom of the U.S. for teacher pensions, largely because, as horrifically expensive as the TRS is, it offers meager at best benefits to educators whose teaching careers are shorter than 30 years — that is, the vast majority of them.”

Monopoly-Bargaining Repeal Is Critical Part of Solution In States Like Illinois

While Illinois is in especially bad shape, failing public pensions are the norm in states that have widespread union monopoly-bargaining control over employees in the government sector and lack state Right to Work laws.

A November 2021 survey of Moody’s Investors Service retirement debt estimates published by Wirepoints, a Wilmette, Ill.-based nonprofit, highlights the close connection between increased special privileges for government union bosses and greater public retirement debt.

Wirepoints contributors Ted Dabrowski and John Klingner found that nine of the 10 states with the greatest unfunded state pension liabilities per household have labor laws authorizing and promoting union monopoly bargaining over public employees’ pay, benefits, and work rules and lack Right to Work laws.

On the other hand, 10 of the 11 states with the lowest state-level pension debts per household have Right to Work laws. And most of the 11 either do not authorize government-sector union monopoly bargaining, sharply limit its scope, or flat-out prohibit it.

“To become fiscally viable, Illinois and a number of other states surely need to reform future accruals for government pension benefits for employees who have already been hired, as well as those who haven’t been hired yet, as Wirepoints recommends,” said Mr. Kalb.

“But even when the so-called ‘pension protection’ constitutional provision in Illinois is amended so such reforms can be made, union bosses will still be able to use their monopoly power under state law to block these needed reforms from actually being adopted. Therefore, to save Illinois, it will also be necessary for lawmakers to remove union bosses’ monopoly-bargaining power.”

With Fiscal Catastrophe Staring Illinois in the Face, Real Reform May Be Possible

Given that Big Labor has dominated Illinois politics for decades, prospects for genuine, dramatic reforms in the state capital may seem slim.

But with fiscal catastrophe already staring Illinois legislators in the face, a significant share of them may soon come to recognize that the time is up for a number of erstwhile sacred cows, including forced union dues and government-sector union monopoly bargaining.

This article was originally published in The National Right to Work Committee monthly newsletter. Go here to access previous newsletter posts.

If you have questions about whether union officials are violating your rights, contact the Foundation for free help. To take action by supporting us and fueling the fight against Forced Unionism, click here to donate now.